Investment Options for Financial Goals

A right set of investment options for financial goals and success in your mid-age

How can we help

Financial Services to achieve your goals of wealth creation

Appropriate investment options for financial goals achievement is key to wealth creation. Mutual funds, for instance, can be a great investment vehicle for your life goals.

Just as early age investment planning requires discipline, your mid-age investment requires clarity. You will soon shoulder more responsibility and the investment decisions you make today will go a long way in helping you tomorrow.

Accumulate Funds for your Retirement

A financial expert will bring you clarity about attaining the right investment options for financial goals fulfilment and alternatives. But more importantly, they will help make your investments work in the correct direction.

Three factors that favour your age group

Risk cover

Insist on a bigger insurance cover and protect your family during difficult times.

Diverse goals

From children’s education to overseas trips, make sure you realize different goals.

Stability building

Get on the path to creating financial stability that will last you for a long, long time.

This is what you need to do

The best part of financial planning is it allows you to enjoy the present and yet secure a great future.

Here are the best advice for adults to carry out during your Building Years and transform life:

Define

Clearly identify what you want over time. List out all your goals and then identify what you need to do in order to achieve each of these goals.

Visualize

Imagine what it’d be like to achieve all those goals. Visualizing will motivate you to build the financial discipline for your family’s future.

Balance

Aim to strike a balance between risk and returns. Better your balance, higher the chances that you’ll achieve each of your dream goals.

Accept

Acknowledge and accept what you’ll need to do today and in the future. Visualize your monthly inflow and outflow.

Commit

Take action. Once you’ve chosen your investment strategy, stick to them with discipline and patience.

It’s not always easy to do all of these things yourself, given your other personal and professional commitments.

And that’s exactly where our role as a personal finance expert begins.

Book a free consultation now

Frequently asked questions

First, be sure you have adequate life and health insurance cover. Also be sure to insure your valuable physical assets. Besides, you should have a contingency fund of 6 to 12 months. This fund shouldn’t be locked in any market-related investment; keep it in liquid or ultra-short term debt mutual fund.

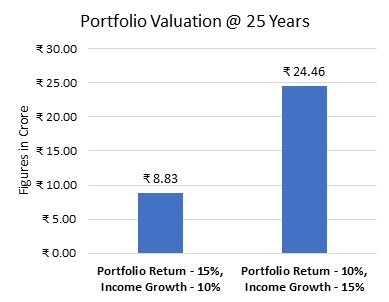

Finally, focus on upgrading your skills. Your professional income would reflect that. Here’s an example that shows how this is so vital.

(Income : 10,00,000, Initial Savings : 2,00,000 and Expense Growth : 10%)Pay close attention to your financial goals and your asset allocation. And it requires a detailed understanding of how to achieve your goals as you strike the right balance. It’s unlikely that your professional commitments could leave you enough time to understand all those intricacies. Which is why you want a skilled and experienced personal finance expert to do it for you.

Over time, we have designed a system that does this efficiently. It has worked very well for all clients and delivered great results. We’d be happy to discuss how it can work for you as well.

Because you are at a much lower health risk at the beginning of this stage, you’ll find it a lot easier to get sufficient life and health cover. Opt for life risk cover that’s at least 10 times your post tax earnings. This should be in addition to any risk cover your organization offers you.

As for health insurance, it depends upon the quantum and items that your organizational insurance covers. If you are working in a fairly senior position, probably your organizational health insurance is enough, but in general, yes, you should have your own health insurance cover.

The starting point is quite simple: identify your short-term and long-term goals, and then invest accordingly.

Debt mutual funds work better for short-term goals, but equity funds are your best choice for your long-term goals.

That means for your long-term goals, it’s probably best to choose a combination of hybrid and pure equity mutual funds. That’s something critical to your wealth creation process over time.

Just like most advice, this too is a piece of generic advice and hence needs to be personalized. We’d be happy to discuss a tailor-made investment plan for you.

Twice a year is good enough. Weekly or monthly reviews almost always add unnecessary noise. They will very likely damage your long-term investment strategy, weaken your investment discipline, and put you at the risk of unduly reacting to even market volatility.

Remember that by reviewing, we mean reviewing and tracking all your financial assets, right from your bank FD and PPF to all your mutual funds investments. This might also give you an idea of how your total financial assets are moving ahead, not just your mutual funds.

Client's speak

FinVoyage's disciplined, patient, and goal-focused approach has helped me to stay away from the external noise regarding the ups and downs of the market. This has really helped me to be on track to achieving my financial goals.

Pratik Parikh

Marketing Executive - Balkrishna Textile Pvt. Ltd., Ahmedabad

I began my association with FinVoyage, when I was a total novice in financial investment planning, and I still continue to be one. FinVoyage has provided me professional expertise and great advice that allows me to pursue my professional goals and enjoy my leisure time with a sense of security that my investments are being managed by a very mature and responsible team of experts.

Tejas Sanghavi

Senior Contracts Manager, Egis International, Doha, Qatar.